avalara tax codes by state

Retailers must separately state the retail delivery fee on all customer invoices and receipts. ST-2 Multiple Site Form.

Nexus And The Sales Tax Puzzle Avalara Video Encore Business Solutions

ZIP codes are a tool for the postal service not tax authorities.

. The tax applies to remote sellers and marketplace facilitators that have no physical presence in Arizona and meet certain economic thresholds. Provides communications tax calculations using information provided by jurisdiction codes. A solution like Avalara allows you to offload the process of researching and applying the tax rates and rules valid at the point of sale.

Pay your bill check your usage or file a support case. Submit the form to receive sales tax rate tables by ZIP code for. Tax rates are incredibly difficult to track at scale.

There are often multiple sales tax rates in each ZIP code county and city. Out-of-State Businesss Code 605. And ST-2-X Amended Multiple Site Form.

Map your tax codes. State-list Placeholder-taxrates-latest-date Important information about using rates based on ZIP codes. Watch videos and join workshops to build your knowledge about tax compliance and Avalara services.

State Sales Tax Registration. Learn about common risks you face when keeping in compliance with state and local tax collection laws. ST-1-X Amended Sales and Use Tax and E911 Surcharge Return.

Out-of-state businesses under the remote seller tax law that went into effect on October 1 are reminded to use business code 605 Retail Classification. Beginning July 1 2022 the state of Colorado is imposing a 027 Retail Delivery Fee on all deliveries by motor vehicle to a location in Colorado with at least one item of tangible personal property subject to state sales and use tax. There are more than 13000 sales and use tax jurisdictions in the United States alone and each one is subject to ongoing rate and taxability updates.

ST-4 Metropolitan Pier and Exposition Authority Food and Beverage Tax Return and the ST-7 Multiple Site Form. Avalara Support and Avalaras developer community are here with answers. ST-8 Tire User Fee.

ST-1 Sales and Use Tax and E911 Surcharge Return.

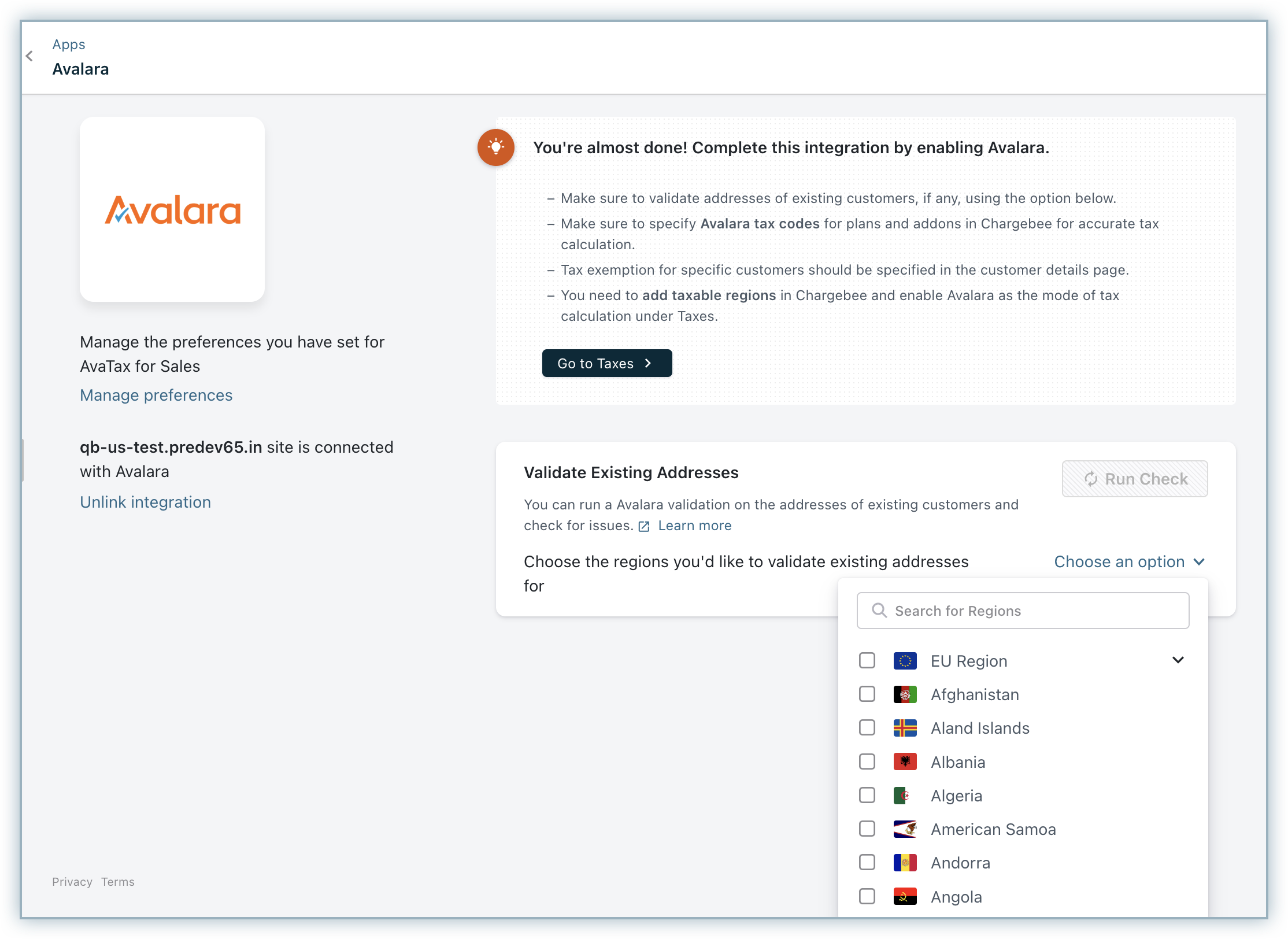

Avatax For Sales Chargebee Docs

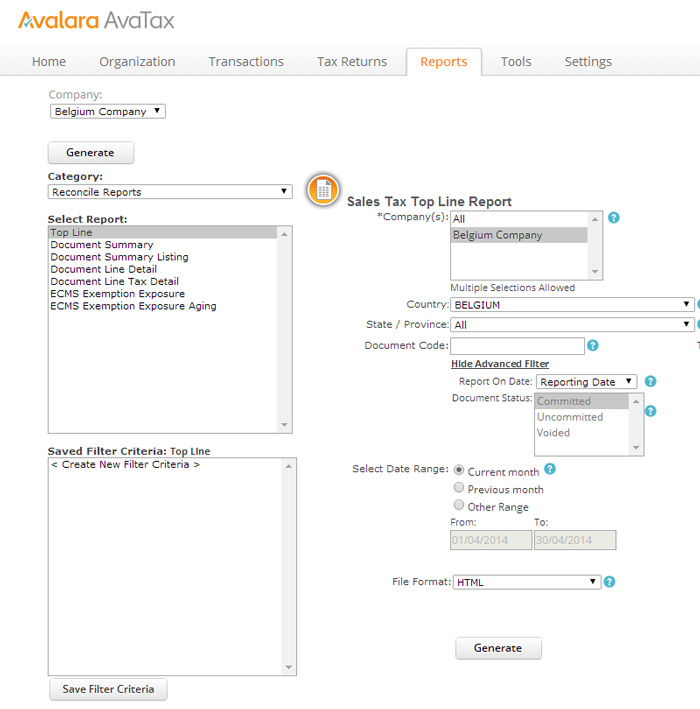

Generate Tax Reports In Avalara Zuora

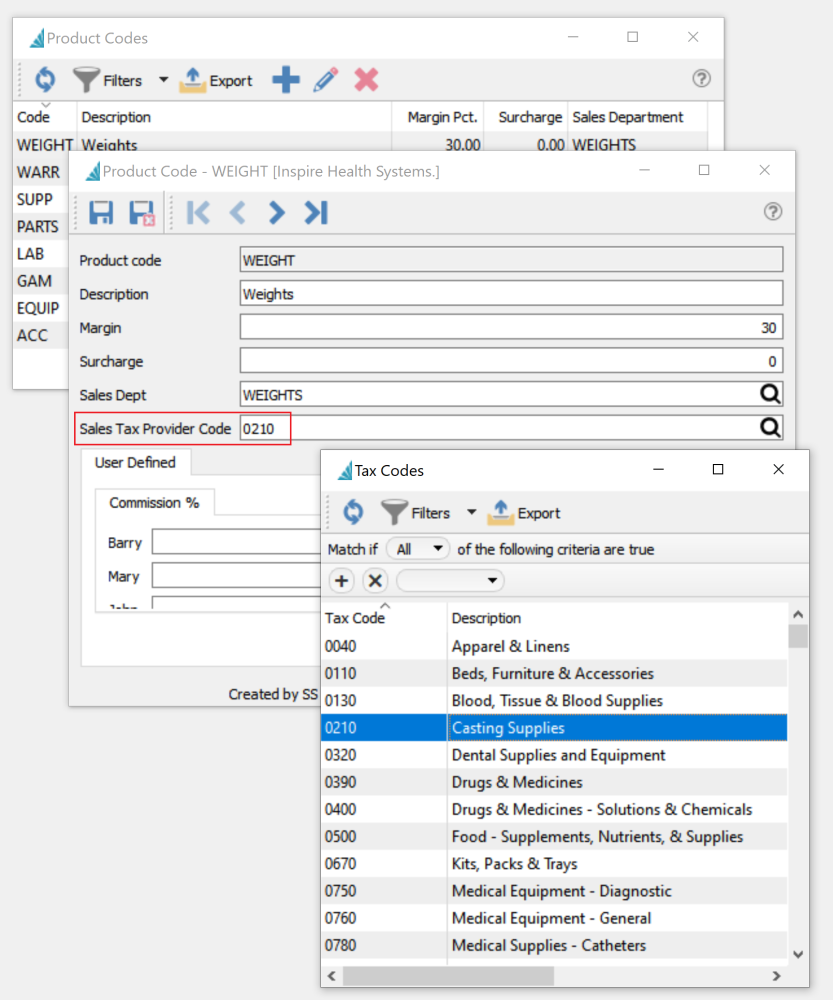

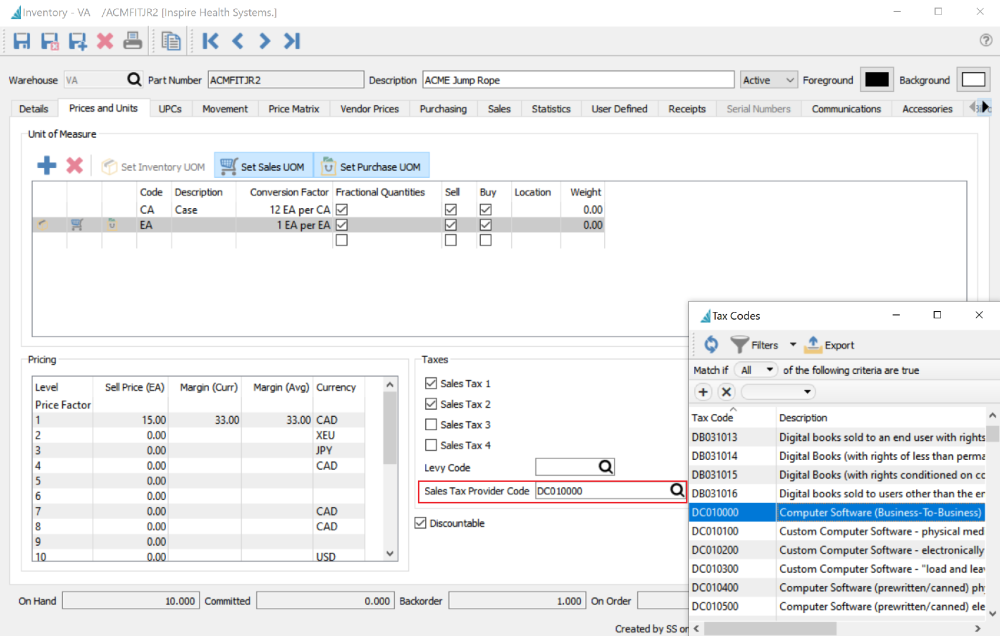

Map The Items You Sell To Avalara Tax Codes Avalara Help Center

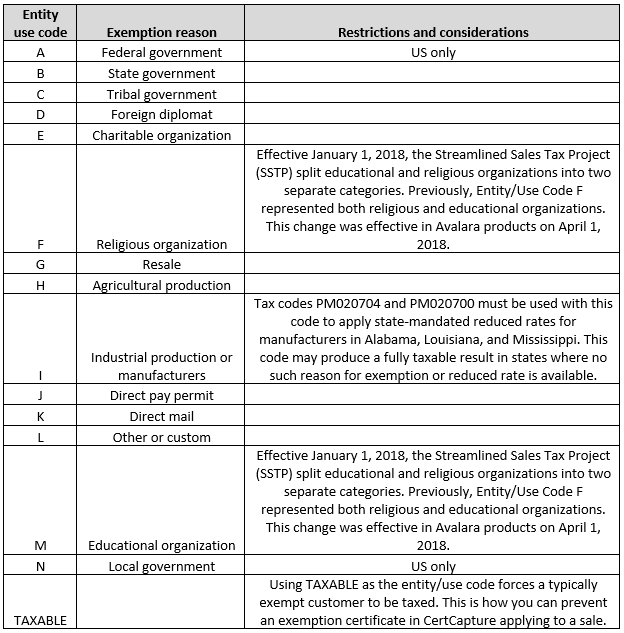

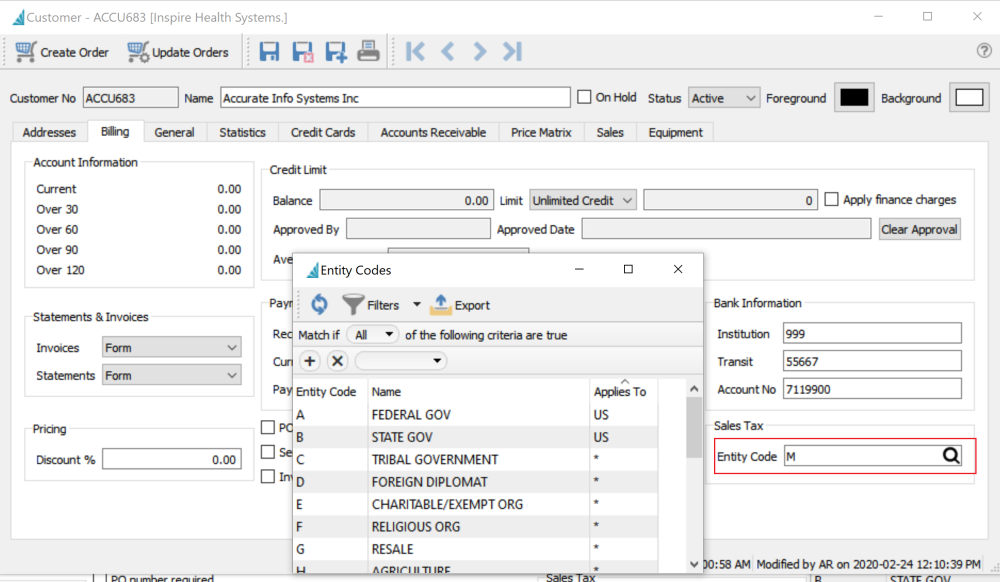

Enablement Steps For Advanced Taxation Nimble Ams Help

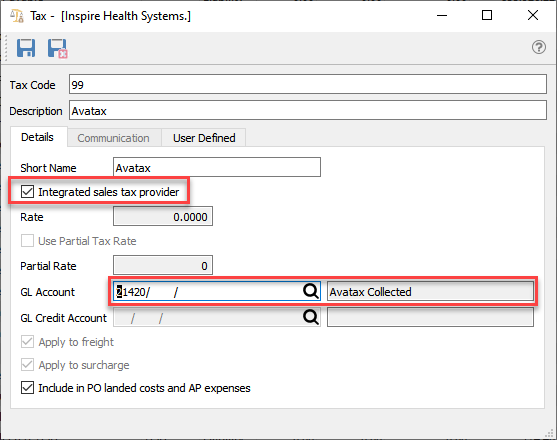

Avalara Sales Tax Spire User Manual 3 5

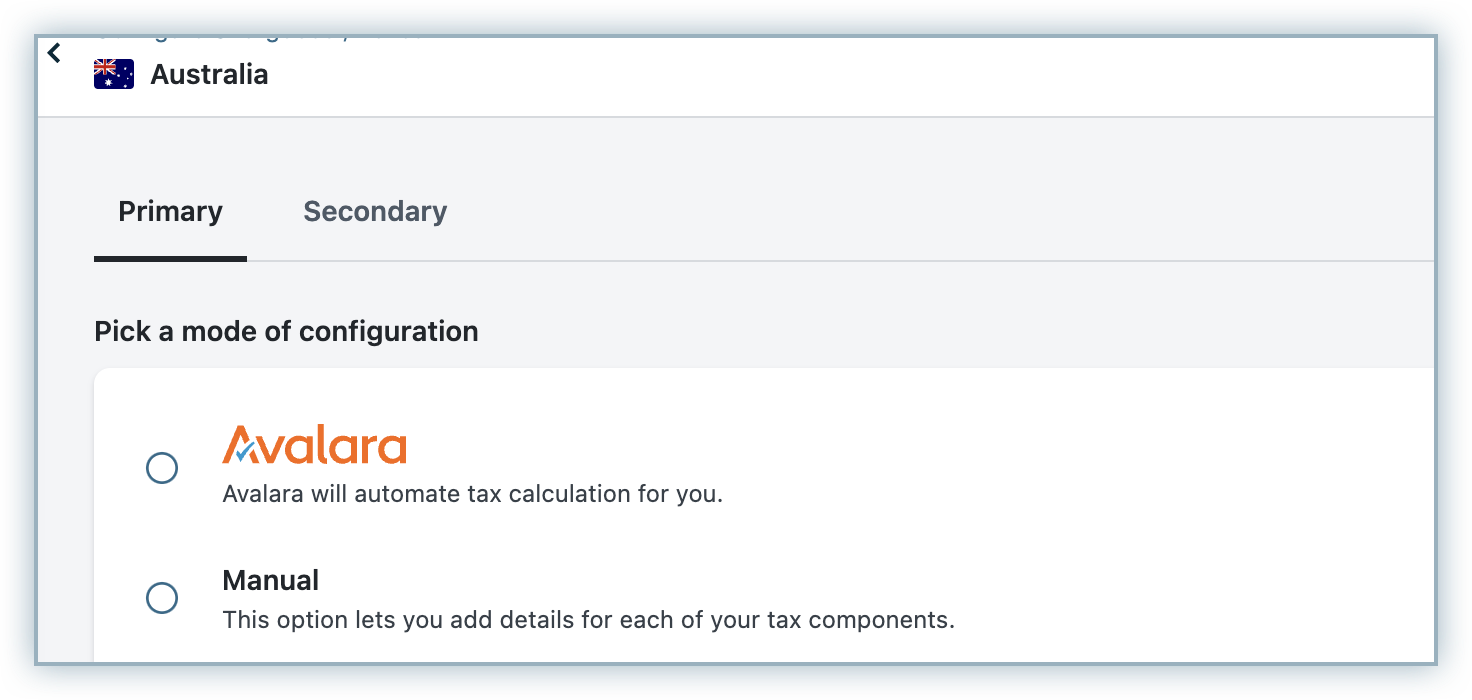

Avatax For Sales Chargebee Docs

Understand Sales Tax Holidays In Avatax Avalara Help Center

Understanding The Avatax For Communications Tax Engine Avalara Help Center

Avalara And Vertex Integration In Sap Business Bydesign Sap Blogs

Wix Stores Collecting Tax In Home Rule States Using Avalara Help Center Wix Com

Avalara Sales Tax Spire User Manual 3 5

Avalara Application By Kibo Ecommerce

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

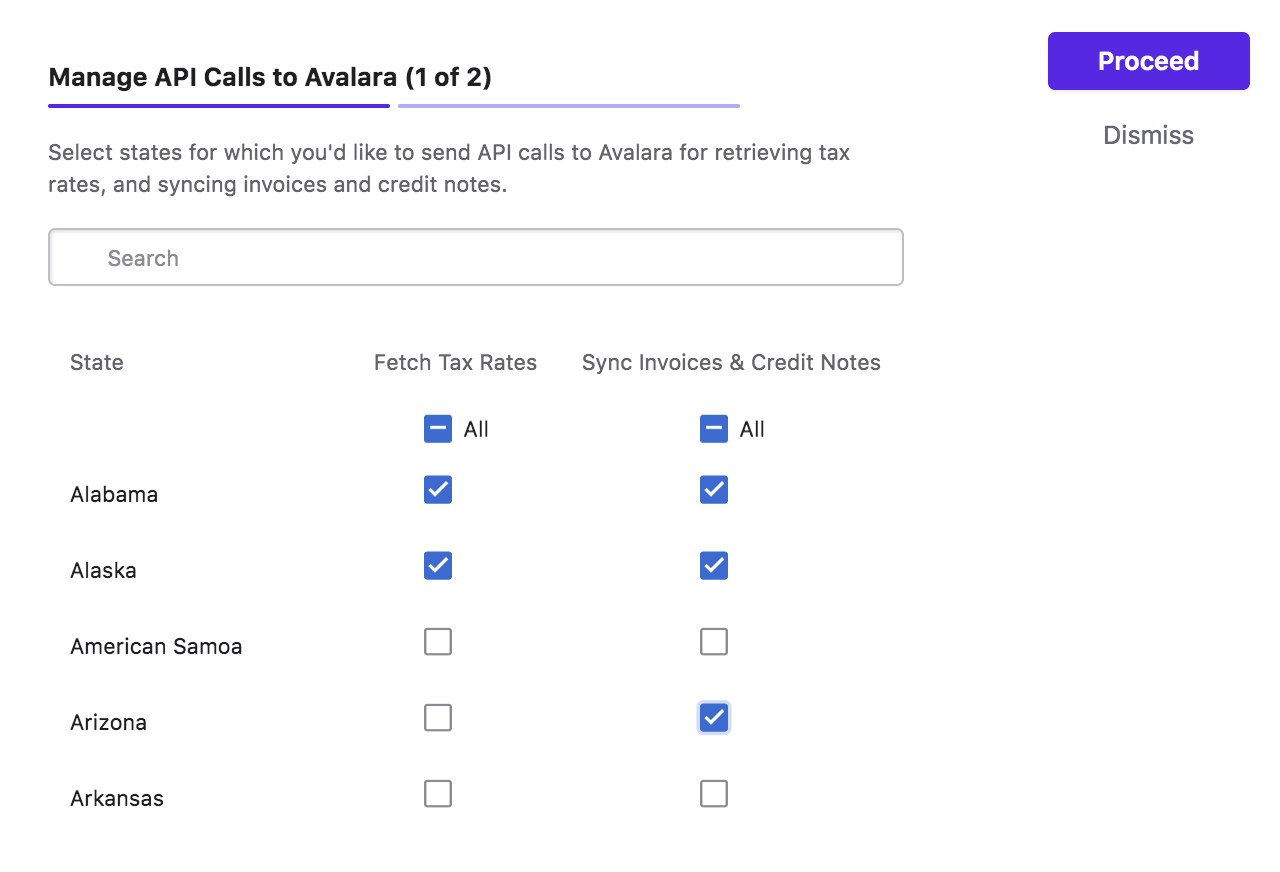

Avatax For Sales Chargebee Docs

Avalara Sales Tax Spire User Manual 3 5

Avalara Sales Tax Spire User Manual 3 5